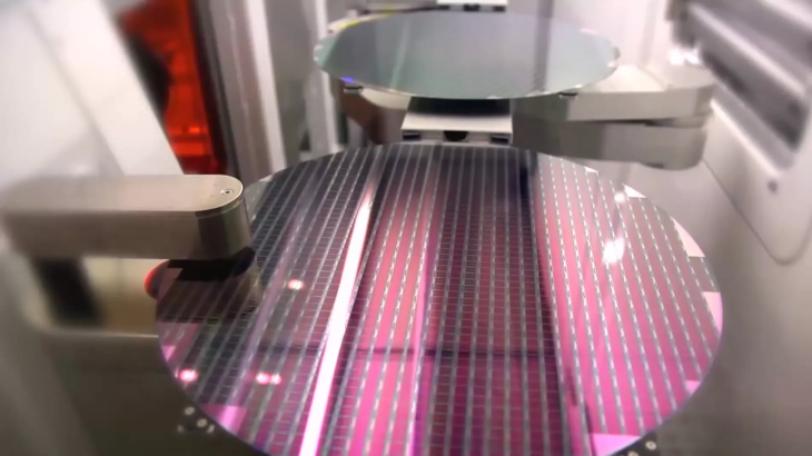

TSMC Falls Under NT$400, a Record Low in 27 Months 台積電失守400元跌至395.5元 27個月新低

Taiwan Stock market opened low and stayed low, dropping below the 13,000 threshold intraday with TSMC falling under NT$400, setting a record low in 27 months.

The Taiwan Stock plummeted 596.25 points on Tuesday, Oct. 11, closing at a record low in recent two years. The Financial Supervisory Commission again announced an expansion of its ban on short-selling, starting Oct. 12, reducing the limit on securities lending short-selling from 20 percent to 10 percent, while the margin percentage of publicly-traded and over-the-counter securities is increased from 100 percent to 120 percent. However, a legislator questions the efficacy of this "peeling the onion" measure to rescue the market.

Lin Te-fu, Legislator (KMT): “Can this peeling-the-onion strategy really save the market? How long will this last? ”

Huang Tien-mu, Commissioner, Financial Supervisory Commission: “I believe there should be different measures indicating the government's attitude towards the welfare of the market at different stages. Actually, with the overall negative atmosphere spreading, it is indeed hard to know how long this will last.”

Huang notes that the Taiwan Stock performance recently had been affected by Fed's interest rate hike, heightened Russia-Ukraine war, and adjustment in the PHLX Semiconductor Index over the long weekend, resulting in semiconductor- and technology-heavy Taiwan Stock to close with a big drop on Oct. 11. However, Taiwan Stock still upholds solid fundamentals and he maintains his confidence in Taiwan Stock. Nevertheless, the market opened low and stayed low on Oct. 12, dipping below the 13,000 threshold, dropping over 115 points to the lowest at 12,991. Weight stocks appear a mass of green while TSMC price fell below NT$400, with the lowest to NT$395.5, setting a record low in 27 months.

Wang Rong-hsu, Analyst: “The global trend is still looking downward, and if the downward trend is not changing, these remedial measures to rescue the market will be discounted. As long as the U.S. stock continues to drop, foreign investments will continue to withdraw from the market.”

In addition, the International Monetary Fund announced its latest quarterly report and downward-adjusted the global GDP. National Development Council Minister Kung Ming-hsin said at the Legislative Yuan that the situation in Taiwan compares favorably with the rest of the world and currently forecasts this year's GDP at 3.3 percent.

台股週二崩跌596.25點,收盤創近2年新低點,金管會再宣布擴大限空令幅度,12日起,盤中借券賣出的限額由20%縮小到10%,上市及上櫃有價證券的保證金成數也從100%再拉高120%,但有立委質疑這種剝洋葱式措施可以救市嗎?

國民黨立委林德福表示:「這個剝洋蔥式的這種策略,能夠救股市嗎?」

黃天牧回應:「我認為至少釋放出在不同階段,政府關心股市的一個態度。」

但面對立委詢問「認為能夠用多久」,黃天牧也坦言:「目前負面情緒蔓延,不知道會到什麼時候。」

黃天牧表示,台股這段時間受到聯準會升息及俄烏戰爭加劇,加上連假期間美國費城半導體修正,讓半導體和科技類股比重大的台股,11日收盤跌得較深,市場管理措施是兩面刃,不過台股仍有基本面,也對台股保持信心。但12日大盤仍開低走低,指數一度摜破萬3,重挫115點,最低來到12991點,權值股幾乎一片綠油油,台積電更失守400元,最低跌至395.5元,創下27個月來新低。

分析師王榮旭指出:「目前國際的一個趨勢還是向下,這個向下的一個趨勢如果沒有改變的話,其實這一些救市的一個政策必然是大打折扣,美股只要不止跌,外資就持續對台股提款。」

另外,國際貨幣基金公布最新季報,下修全世界經濟成長率,國發會主委龔明鑫上午在立院表示,台灣情況相對全世界樂觀,目前預估今年GDP成長率可望超過3.3%。