TSMC Returning to the NT$400 Mark 台積電一度大漲21元 重新站回400元大關

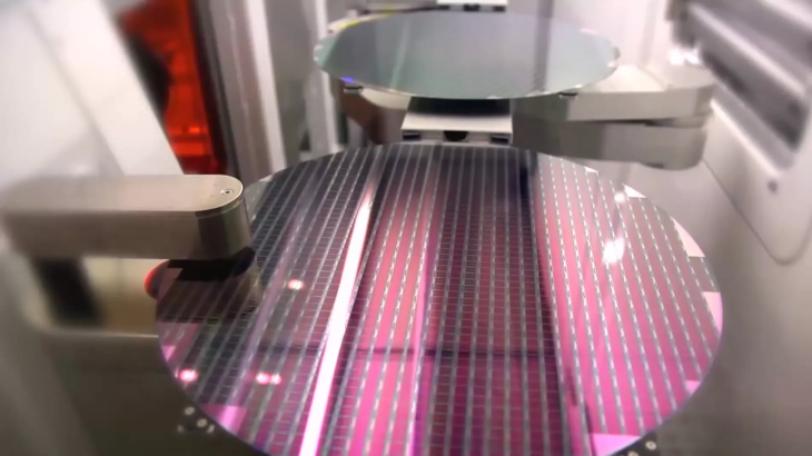

Following the rebound of U.S. stocks, Taiwan stocks jumped in early trading on the 14th rising 212 points, recovering the 10,000-level mark. TSMC also rebounded, rising NT$21 during the session and returning to the NT$400 mark.

The US stock market reversed and closed higher on the 13th as the Dow Jones Industrial Average rose 827.87 points and the Nasdaq rose 232.05 points. Taipei stock market followed suit and rebounded strongly on the 14th, with a sharp rise of 212 points. The three indexes of electronics, finance and manufacturing rose more than 400 points during the session, reaching a maximum of 13,221 points. TSMC revealed at its investors conference that it maintained a high-profit level in the fourth quarter. Its stock price reached a maximum of NT$416 in early trading, up NT$21 or 5.32 percent.

Wang Jung-hsu, CEO, Marbo Investment Advisors:“When is the economy recovering? TSMC expects the chip industry to recover in the second half of next year. This means there's a lot of pressure on the industry until the first half of next year.”

As U.S. inflation continued rising, consumer prices in September increased by 8.2 percent year-on-year, higher than market expectations. The market estimates that the probability of the Federal Reserve raising interest rates by 0.75 percent again in November exceeds 98 percent. U.S. companies will be releasing their third quarter financial results soon. The index recovered on the 14th, led by electronic stocks that fell previously deeply. However, exactly how long the rally will last remains to be seen.

Taiwan stocks continued to collapse in recent days. And even TSMC fell below the NT$400 level. Premier Su Tseng-chang once again spoke with confidence in the Legislative Yuan in the morning that he will respond to the impacts.

Premier Su Tseng-chang:“The Russia-Ukraine war, and rising U.S. interest rates, have repeatedly affected the global stock market. Taiwan's overall economic fundamentals are good. The government will respond relevantly to certain economic impacts.”

Investors are also concerned about whether the Financial Supervisory Commission will take further measures to save the market. The FSC said that looking back at historical records, it could prohibit short-selling but the market will not be closed. It will manage the market dynamically according to market conditions.

美股13號逆轉收高,道瓊終場大漲827.87點、那斯達克指數也勁揚232.05點,激勵台北股市14號同步強勁反彈,以大漲212點開出收復萬三大關,在電子、金融與傳產3大指數齊彈下,指數一路走高,盤中大漲超過400點,最高來到13221點。而台積電在法說會上表示,第四季維持高檔獲利水準,早盤股價最高來到416元,大漲21元,漲幅5.32%。

萬寶投顧執行長王榮旭表示:「景氣的一個回升的時間點到底在哪裡,像台積電的一個部分它是預期就是說,明年下半年整個產業的一個成長力道才會重新回來,代表就是說其實到明年上半年,其實整個產業的一個修正的一個壓力還是有的。」

由於美國通膨持續惡化,9月消費者物價年增8.2%,高於市場預期,市場預估聯準會11月再次決議升息3碼的機率超過98%,分析師認為,除了升息,美股接下來也將陸續公佈財報,雖然14號大盤在跌深的電子股領漲下,指數跌深反彈,但漲勢能持續多久,仍待進一步觀察。而近日台股持續崩跌,就連護國神山台積電都一度跌破400元關卡,行政院長蘇貞昌上午在立院也再次信心喊話,會對衝擊做相關因應。

行政院長蘇貞昌表示:「俄烏戰爭美國一再升息,種種都會影響全球的股匯市,而台灣整體經濟基本面良好,政府會對於影響所產生的衝擊做相關的因應。」

另外,外界也關切金管會是否會進一步採取救市措施,金管會則表示,回溯歷史紀錄,最壞就是禁止放空,不會休市但市場管理是動態的,會視市場狀況決定。&&