Fed Expected to Raise Rates by 0.75% Again 美聯準會本週利率會議 市場估再升息3碼

The Fed is expected to deliver another 75 basis point rate hike after this week's FOMC meeting. Meanwhile, in the morning on Oct. 31, TAIEX recovered above the 12,900 level with the rebound of electronic and financial stocks.

The U.S. Federal Reserve will meet this week and announce its interest rate decision in the early morning of Nov. 3. The Fed is expected to raise interest rates by another 0.75 percent and continue rate hikes until the first quarter of 2023. Monetary policy won't easily be changed until inflation slows down significantly.

Chiu Ta-sheng, Researcher, TIER: “The global financial crisis occurred because the Fed raised interest rates by a total of 4.25 percent over a two-year period. But now, it looks like the Fed will raise rates by 4.25 percent in one year. So of course there will be doubts that the rate hike is overdone. The more reassuring news is that the current financial leverage is not the same as before the financial crisis. The entire financial health now is relatively better than at that point in time.”

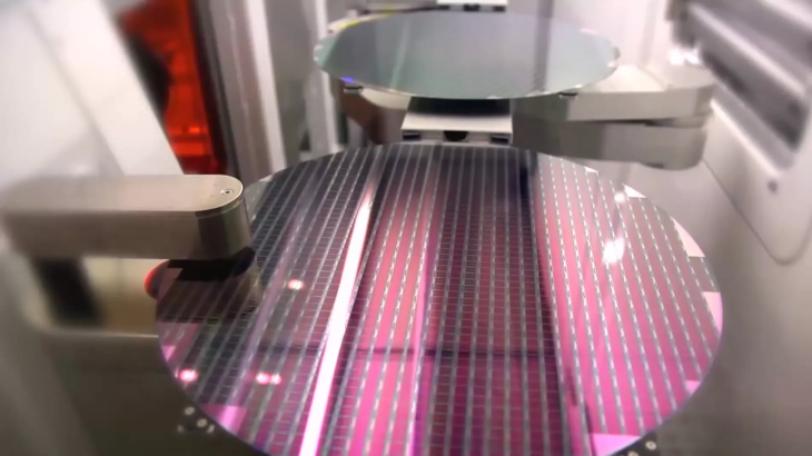

Domestic analysts said that judging from the latest U.S. personal consumption expenditures price index, the value is lower than expected. In contrast with that, the U.S. job market is still quite booming. Although now is a good time to suppress inflation, the Fed still needs to decide between employment and inflation. Adopting aggressive rate hikes will definitely have an impact on the end market demand. The four major U.S. stock indexes closed higher on the 28th. Taiwan stocks opened in positive territory on the 31st. The TAIEX recovered above the 12,900 level with the rebound of electronic and financial stocks. TSMC, the leader in foundry manufacturing, rose NT$7 at the opening and its stock price rose above NT$386.5. The company's market value returned to above NT$10 trillion.

Wang Jung-hsu, CEO, Marbo Investment Advisors: “In fact, foreign investment is still biased towards TSMC. If the U.S. stock market, especially U.S. tech stocks, falls again, TSMC will probably become the target of foreign selling again.”

Analysts said that the recent decline in Taiwan stocks was mainly affected by international trends and the market is still worried about U.S. inflation. In addition, the Federal Reserve may raise interest rates by 0.75 percent again this week. Investors still need to be cautious.

美國聯準會將在本週二及週三兩天召開利率會議,週四的清晨公布利率決策,外界普遍預估,會再升息3碼,且升息循環可能會持續至2023年第一季,在通膨明顯趨緩前貨幣政策立場不會輕易轉向。

台經院國際處研究員邱達生說道:「全球金融海嘯那時候會爆發,是因為在兩年的期間聯準會總共升息17碼,但是現在看樣子是聯準會一年就要升17碼,所以當然是會有(升息過頭)的疑慮。比較可以放心的消息是,因為現在的金融的這種槓桿的情況,跟金融海嘯之前是不太一樣的,整個金融體質比那個時間點,算是比較健康。」

國內學者表示,從美國最新的個人消費支出物價指數PCE來看,數值是低於預期的,但美國的就業市場又相當蓬勃,雖然現在是一個打壓通膨的好時間點,不過聯準會仍會在這兩部分中做取捨,因為若採激進升息,一定會對終端市場需求會有衝擊。上週五美股四大指數收高,連帶激勵台股開紅盤,在電子股反彈加上金融股開高助攻下,指數收復12900點整數關卡,晶圓代工龍頭台積電,開高後勁揚7元,股價也回升到386.5元之上,市值重返10兆元之上。

萬寶投顧執行長王榮旭表示:「外資其實操作還是偏向於調節台積電,如果說美國股市,特別是美國科技股的部分又再往下跌的話,恐怕台積電又會成為外資調節的對象。」

分析師表示,這陣子台股下跌,主要是受到國際趨勢影響,且目前市場仍擔憂美國通膨問題,加上本週聯準會可能會再度升息3碼,投資人操作仍須謹慎。