Domestic Banks Sell Stocks for Safety 金融3業持股急降 本國銀行賣股避險

Taiwan stocks have fallen by more than 30 percent this year due to global financial market volatility. Stocks have fallen by 11 percent in September alone. The FSC discovered September shareholding by life insurance companies, banks, and securities firms has dropped sharply. Domestic banks have sold NT$136.5 billion of shares and invested more than NT$280 billion into bonds to hedge.

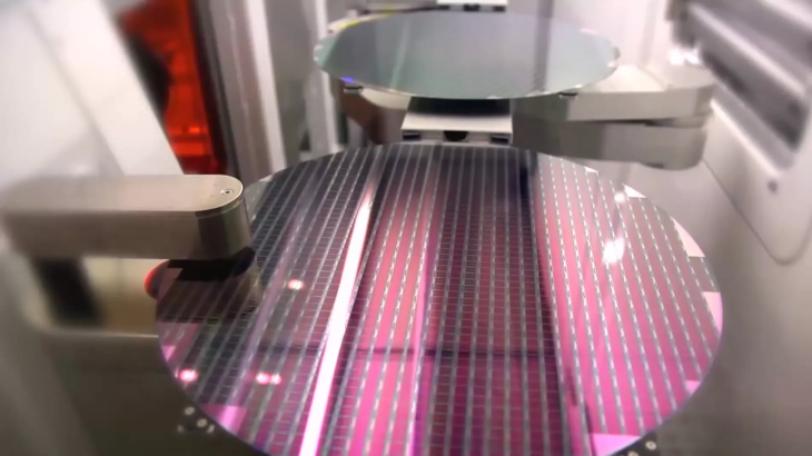

Although U.S. GDP in the third quarter was better than expected, the four major U.S. stock indexes closed mixed on Oct. 27 due to poor financial reports from major technology companies. Taiwan stocks opened at 12,874 points in early trading on the 28th and turned lower. The TAIEX fell by more than 100 points during the session, reaching a low of 12,807 points, due to weakening electronics and manufacturing stocks. TSMC announced the establishment of its 3D Fabric Alliance, an open innovation platform. 19 partners have joined so far, with invitations to international manufacturers Micron, SK Hynix, Samsung, and others to promote the development of 3D semiconductors for the first time. However, TSMC's stock still fell by NT$6.5 in early trading and broke the NT$380 level.

Chu Hsiang-sheng, Chairperson, Hua Nan Securities Investment Management: “Everyone knows the whole consumer electronics market is very bad. It is expected that TSMC will have some decline in future capacity utilization rate with its mature or advanced process. This is the part that the market is more worried about. The establishment of an open innovation platform is a long-term industrial plan. It won't bloom so soon. ”

Taiwan stocks have been affected by the global financial market volatility this year. The TAIEX has fallen from a high of 18,619 at the beginning of the year to below 13,000, a drop of more than 30 percent. The Financial Supervisory Commission also found that shareholding levels dropped sharply in September at life insurance, banks, and securities firms. Stock ownership plummeted from NT$3.1 trillion in August to below NT$2.6 trillion. Domestic banks sold NT$136.5 billion in shares and invested more than NT$280 billion into bonds for safety. This is one of the reasons why Taiwan stocks plunged by more than 11 percent in September.

Huang Tien-mu, Chairperson, Financial Supervisory Commission: “I think the industry changing its investment target is based on business strategy. We still respect the companies' strategy. The point is how we make our capital market sustainable and have corporate governance in our publicly listed companies.”

Huang believes that although we have encountered challenges such as inflation and U.S. interest rate hikes at this stage, it should be only a transitional period. The market's price-earnings ratio as of the end of September is about 9.74 times. The cash yield rate plus stock dividends are 5.34 percent. Medium and long-term fundamentals are still good. Investors need not worry too much but still need to choose stocks carefully.

儘管美國第3季的國內生產毛額GDP優於預期,但在主要科技公司財報不佳影響下,讓週四美股四大指數收盤漲跌不一,而台股早盤以12874點開出後,指數開低走低,在電子、傳產走弱下,盤中大跌逾百點,最低來到12807點。儘管台積電宣布,成立開放創新平台3D Fabric聯盟,目前已有19個合作夥伴加入,也首度邀請國際大廠美光、SK海力士、三星等要來推動3D半導體發展,但早盤台積電仍下跌6.5元,失守380元關卡。

華南投顧董事長儲祥生表示:「大家知道整個消費性電子的市況非常糟糕,預期台積電在有些,不管是成熟或先進製程,可能未來的產能利用率都會往下降,這是市場比較擔心的部份,(成立開放創新平台)這個長期的產業布局,它不會那麼快開花結果。」

台股今年受全球金融市場震盪影響,加權指數已從年初高點18619點跌到失守萬3大關,跌幅已超過30%。金管會統計也發現,包含壽險、銀行與證券商在內的金融3業,9月持股水位急降,股票部位從8月的3.1兆元驟減至2.6兆元之下。另外,本國銀行大舉賣股1365億元,資金轉進債券逾2800億元避險,成台股9月急殺逾11%的原因之一。

金管會主委黃天牧表示:「我想業者在投資上面標的的轉換,這是他基於它業務策略所需,還是尊重業者的策略,重點還是我們怎麼樣把我們的資本市場,能夠上市櫃公司在公司治理,永續方面把它做得很好。」

黃天牧認為,雖然現階段遇到了通膨跟美升息這些挑戰,但應該都只是過渡期間,集中市場截至9月底本益比約9.74倍,現金殖利率達加計股票股利為5.34%,中長期基本面仍良好,投資人不用過度擔心,但仍需審慎選股。