Pelosi's Reported Visit Sends TAIEX Tumbling 台海緊張衝擊台股 盤中一度跌逾3百點

The reported visit to Taiwan by U.S. House of Representatives Speaker Nancy Pelosi has strained the China-U.S.-Taiwan relationship and spooked investors. On Aug. 2, the Taiwan Stock Exchange tumbled over 300 points to fall below the critical 14,700-point level. TSMC opened low, and its stock price fell below NT$500.

There are reports that U.S. House of Representatives Speaker Nancy Pelosi will arrive in Taiwan for a visit on Aug. 2. Her reported visit further strained the already tense cross-Strait relationship and spooked investors. On Aug. 2, the Taiwan Stock Exchange plummeted 120.75 points as soon as it opened and the board was virtually entirely green. At one point, the tumble exceeded 300 points to fall below the critical 14,700-point level.

David Chu, Chairperson, Hua Nan Securities: “Stocks fell 2 percent today, and the only thing that comes to mind is Pelosi's visit to Taiwan. Everyone is worried about cross-Strait political issues. You can see that both the stock market and the foreign exchange fell today, which shows that foreign investors were selling Taiwan stocks today.”

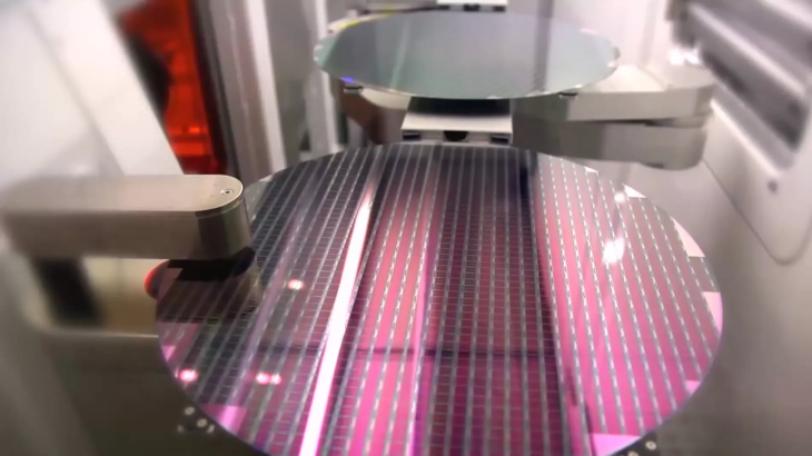

There was pressure to sell as investors panicked over the tense cross-Strait situation. Declines were seen in stocks in the electronics, shipping, and aviation sectors. TSMC's share price opened low, directly falling under the five-day and 10-day average. It fell under the NT$500 level, causing the stock exchange to slide by over 2 percent.

TSMC Chairperson Mark Liu told a foreign media outlet that a Taiwan Strait war would destroy the world's rules-based order. He also said no one can control TSMC by force and operations can only continue if there are real-time connections with partners across the world.

David Chu, Chairperson, Hua Nan Securities: “Yesterday, TSMC's ADR fell by about 2 percent. Today, it looks like semiconductors and IC design and even some biotech stocks are sustaining heavy losses. This means that all major stocks are weak.”

Analysts said U.S. stocks have rebounded recently, but Taiwan's stocks have not kept up, primarily due to political issues. In addition, Taiwan's electronics sector plays an important role. Whether the stock exchange has the chance to rebound in the future will depend on whether the inventory can be digested.

外傳美國眾議院議長裴洛西2日晚上訪台,消息一出,引發台海情勢緊張,衝擊投資人信心。台北股市2日開盤以大跌120.75點開出後,盤面上一片綠油油,盤中一度下跌超過300點,跌破14700點關卡,目前大盤仍呈現震盪格局。

華南永昌證券董事長儲祥生表示:「對照台股今天跌到2%,我覺得唯一大家能夠聯想到的就是,因為裴洛西要來台灣。台海之間那個政治上的議題,大家比較擔心,事實上你可以看到今天是股匯雙跌,代表應該今天外資有去賣台股。」

在台海緊張氣氛增溫的恐慌情緒下,台股賣壓出籠,包括電子權值股、航運、航空等類股都呈現下挫格局。而護國神山台積電則是跳空開低,直接摜破5日與10日線,失守500元大關,也拖累台股跌幅逾2%。

台積電董事長劉德音接受外媒專訪時直言,台海戰爭將打亂全球現有秩序,沒有人能透過武力控制台積電,唯有即時連結外在世界才得以維持營運。

華南永昌證券董事長儲祥生說:「昨天台積電ADR大概就跌了2%,今天看起來半導體IC設計,甚至有些生技股票今天都重跌。代表整個大盤的架構上,主要的股票全部都弱勢。」

分析師表示,近期美股呈現一個反彈格局,但台股暫時沒有跟上,政治議題是影響最大的部分,而且台灣的電子產業扮演著重要角色,要持續觀察接下來消化庫存的狀況,來決定台股未來有沒有機會做一個回升的行情。