Definition of 'Advanced Manufacturing' Needs to Be Clarified 「台版晶片法案」審議 先進製程等定義遭質疑

Today, the Legislative Yuan reviewed the amendment, which has been dubbed Taiwan's Chips Act. Both the ruling and opposition parties are in support of the amendment, but lawmakers still raised questions to some of the terms.

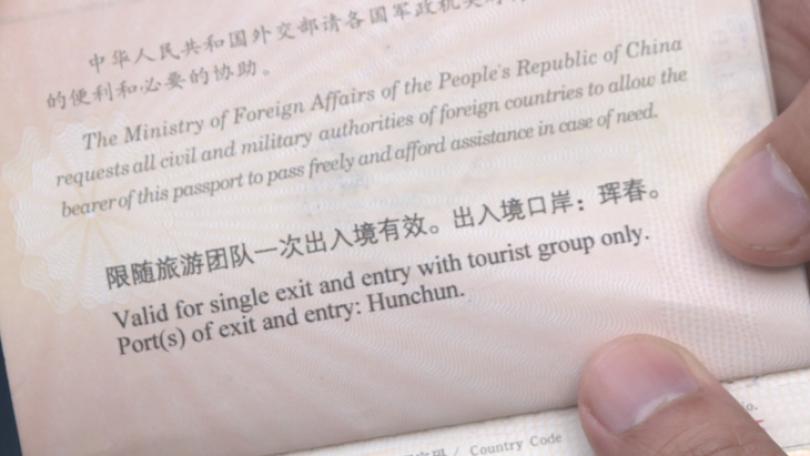

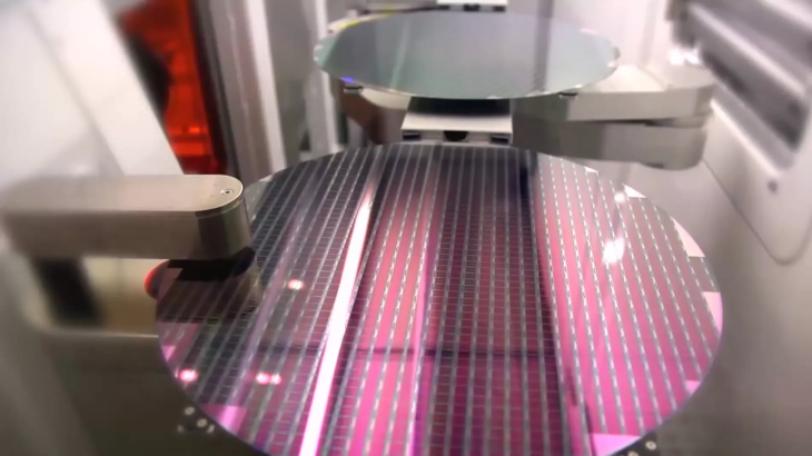

With the Taiwan Semiconductor Manufacturing Company (TSMC) building a factory in the U.S., there are speculations that Taiwan may be losing its competitive edge in the worldwide chip industry. On Nov. 17, 2022, the Executive Yuan passed the draft amendment to Articles 10-2 of the Statute for Industrial Innovation. Both ruling and opposition parties are in support of the amendment but lawmakers are asking for further clarification on the definition of "advanced manufacturing," and the parameters for nanometers when defining mature processing. Minister of Economic Affairs, Wang Mei-hua, said each case will be audited and decided separately by the expert committee.

Wang Mei-hua, Minister, MOEA: “”

Chiu Yi-Ying, Legislator (DPP): “”

Whether it's considered advanced manufacturing or forward-looking R&D will be decided by the members appointed to the expert committee. Yes, we will... Is the expert committee reviewing the company or checking whether they fit the definition and criteria? Committee will decide whether their technology falls under the definition and criteria.

Under the amendment, high-tech companies that hold key positions in the global supply chain are eligible for a tax credit of 25 percent for forward-looking R&D expenses. In addition, a business tax reduction of 5 percent can be claimed for spending on equipment for advanced manufacturing. These can all be deducted from the overall income tax of the year. Taiwan People's Party (TPP) legislator Kao Hung-an pointed out that the amendment was too hastily written. It is therefore rough and unclear on the effect it would have on the national income tax, and which companies can qualify.

Wang Mei-hua, Minister, MOEA: “”

Kao Hung-an, Legislator (TPP): “”

If the effective tax rate failed to reach 12 percent, even cutting the R&D spending will not do. The effective tax rate threshold, as you said, is at 12 percent, but here's where the problem lies. If each case should be judged on its own as you mentioned earlier, how can companies from all sectors fit into one kind of standard and how do you decide who qualifies? What is it that the Statute of Industrial Innovation truly upholds?

Major German newspaper The Daily Mirror recently published a long report on how Taiwan's semiconductor development impacts the world; it highlighted the importance of guarding Taiwan against a possible invasion from China.

台積電赴美設廠,多位立委擔憂人才外流、技術流失,未來台灣恐怕無法處於領先地位。被外界認為是「台版晶片法案」的《產業創新條例》10條之2修法,朝野各黨團都給予修法精神肯定,但也對草案中的先進製程等定義、以及多少奈米以下,才算是成熟製程提出質疑。王美花回應,將視個案由專家學者組成委員會審查。

經濟部長王美花說明:「他是屬於先進製程的部分,還是前瞻創新的部分,還需要經過你們所謂學者專家,再去組成一個委員會,來審查這樣。」

民進黨立委邱議瑩則追問:「(我們會用)你的專家委員會,是審查這個企業,還是審查這個定義,審查這個定義下面可以適用的技術?」

修法內容包括未來技術創新、且居國際供應鏈關鍵地位的公司,研發費用的25%,以及購置先進製程的全新機器等支出的5%,都可以抵減當年度營所稅。除了定義不清楚,民眾黨立委高虹安也指出,修法倉促且模糊,無法得知修法後影響國家財稅多少,也無法了解那些產業適用。

經濟部長王美花表示:「如果沒有到12%的時候,其實其他你在研發的費用再降低,其實也會進不來。」

民眾黨立委高虹安指出:「雖然您剛剛講好,有效稅率12%,可是問題是在這裡面,你如果未來,你是要走剛剛講的個案審查,那到底誰可以適用進入這個個案裡面,到底什麼精神是台版晶片法案贊成的?」

半導體產業發展,攸關台灣經濟情勢,德國每日鏡報10日大篇幅報導,台灣半導體產業對全球的影響力,外國學者認為全球經濟繁榮取決於台灣的安全與否,因此保護台灣不受中國侵略非常重要。