Investors Suffer From FTX's Sudden Bankruptcy FTX破產重創幣圈 金管會擬祭「漸進式」納管

The world's second largest crypto currency exchange FTX declared bankruptcy in November. Many investors in Taiwan had suffered major losses. The Financial Supervisory Commission says it has no jurisdiction over FTX while legislating specialized laws here could take a long time.

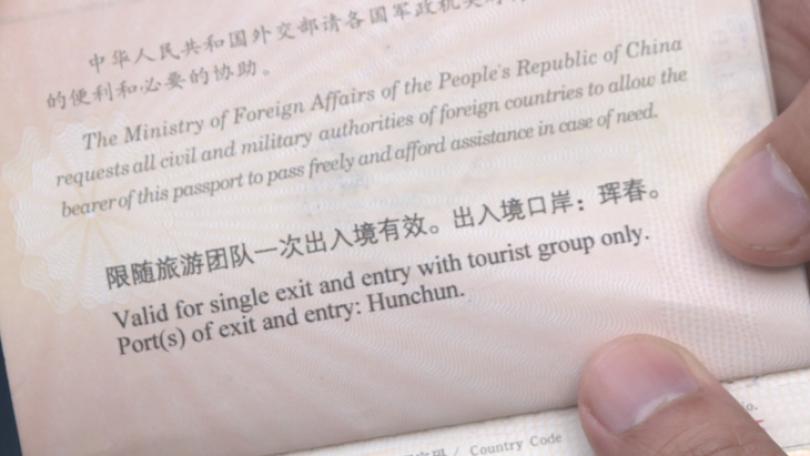

Mr. Huang, who takes on IT projects, previously put his funds in the crypto exchange FTX. He did not expect that FTX would go bankrupt without warning and invested millions of U.S. Dollars over time. Whether he can retrieve his funds is still unknown.

Huang Shih-kai, Victim: “I happened to put some digital currencies on FTX. And this bankruptcy happened. This amount is not small, right? It will impact me greatly if my funds are stuck.”

A KMT think tank directly pointed out that the FTX bankruptcy is the crypto industry's Lehman Brothers moment, which will have a chain reaction. It is roughly estimated that there are hundreds of thousands of victims in Taiwan, and the loss is about NT$15 billion. However, FTX has no subsidiaries in Taiwan. Victims can only form self-help associations and appoint lawyers to sue overseas. The Bitcoin and Crypto Currency Development Association suggested that Taiwan should learn from Japan and adopt similar regulatory measures.

Peng Shao-fu, Chair, Bitcoin and Crypto Currency Development Association: “Japan has developed a framework because an exchange there previously collapsed. So the country follows that framework and its industry has self-discipline.”

Huang Tien-mu, Chairperson, Financial Supervisory Commission: “We would like to gradually provide investor protection. For example, focusing our attention on asset separation.”

Taiwan currently only has money-laundering prevention guidelines for cryptocurrencies. The FSC said in the future, it will gradually supervise high-risk investments, and provide investor protection by seeking asset separation. The FSC will meet with the Executive Yuan for discussions.

從事資訊接案的黃先生,因熟悉網路以及加密資產市場,之前選擇將資金放在號稱一站式數位資產的FTX平台,沒料到FTX無預警破產,陸續投入累積的百萬美金,能不能拿回來還是未知數。

受害人黃士楷表示:「剛好把一些數位貨幣集中在FTX,那就剛好發生這樣的事情,這金額不小,卡到的話變成說影響的方面蠻廣泛的。」

國民黨智庫直指,FTX破產是虛擬貨幣界的雷曼兄弟事件,將會產生連鎖效應。在台灣粗估也有數十萬受害者,損失約150億元台幣,但是FTX在台並無子公司,在金管會監管措施之外,目前受害人僅能組成自救會,委請律師海外訴訟,虛擬通貨發展協會建議,我國應借鏡日本,祭出類似監管措施。

比特幣及虛擬通貨發展協會理事彭少甫表示:「日本的話他就是因為之前有一個交易所倒閉事件,所以他就因為那個事件有制定一個框架,然後按照那個框架加上業者的自律。」

金管會主委黃天牧表示:「傾向於適度漸進地去就一些跟投資人保護,比方說資產分離這方面特別要去注意他。」

針對目前台灣對加密貨幣,只有洗錢防制規範,金管會鬆口,未來會對高風險投資,祭出適度漸進納管,像是投資人保護上的資產分離等制度,由於涉及跨部會,將報到行政院會討論。