Manufacturers Pessimistic About Next 6 Months 台經院:製造業對未來半年景氣 呈悲觀與持平

"The worst is yet to come." That's the message delivered by the latest survey published by the Taiwan Institute of Economic Research, citing factors including China's COVID control measures, and the Russia-Ukraine war could further impact Taiwan's economy.

The U.S. Federal Reserve released the minutes of its meeting at the beginning of this month. The text suggested that it will slow down the pace of interest rate hikes to 0.50 percent in December to reduce the risk of excessive tightening. The voice of Fed doves has increased. The Taiwan Institute of Economic Research says leading indicators of major economies and the manufacturing PMI continued to show a downward trend in October. In terms of domestic manufacturing, due to the impact of inflation and global interest rate hikes, end-user demand is weak as manufacturers continue to wind down inventory. Investment willingness tends to be conservative and manufacturing companies are mostly pessimistic or indifferent about the next six months.

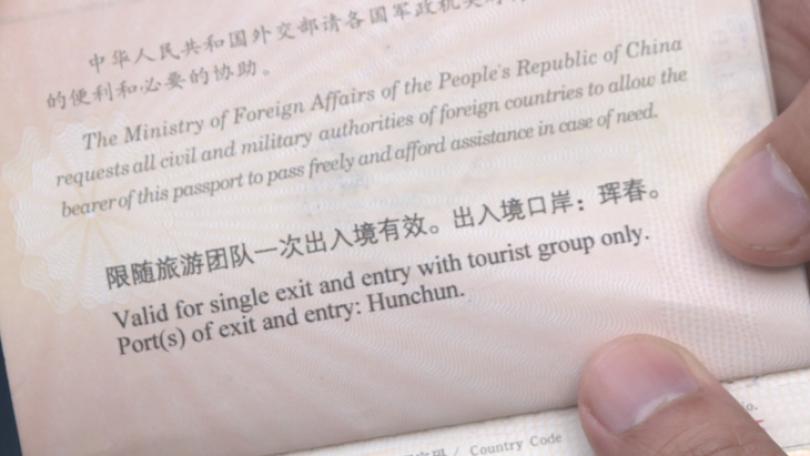

Sun Ming-te, Director, Macroeconomic Forecasting Center, TIER: “I think manufacturers will see better sales in the first quarter of next year as they slowly work through excess inventories. And if inflation slows allowing for more consumer purchasing power and China's COVID restrictions are lifted, the overall business environment should pick back up.”

The economic outlook report from the Organization for Economic Cooperation and Development also shows that the energy shock caused by the Russia-Ukraine war continues to stimulate inflation, and the global economy will further slow down next year.

Chang Chien-yi, President, TIER: “Interest rate hikes should come to an end when the U.S. nominal interest rate exceeds the CPI growth rate. In the future, if China lifts its epidemic restrictions, its production costs will increase and the price of what it sells will go up. This will lead to increased imported inflation in the U.S., which is really worth following.”

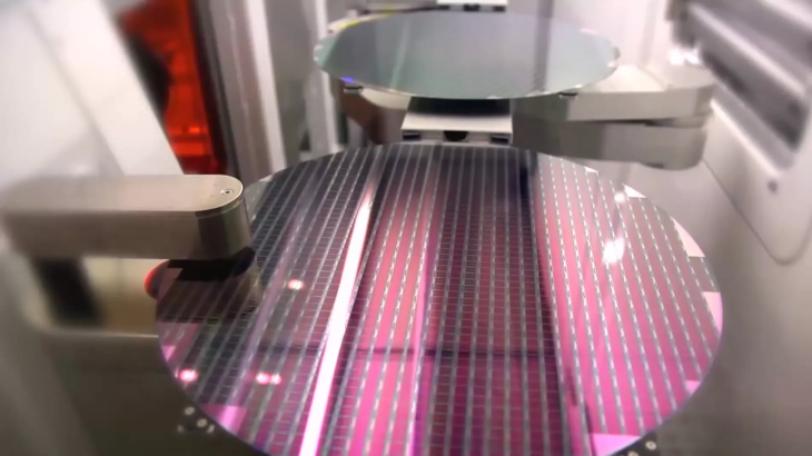

The Taipei stock market fluctuated after a small drop in early trading. Although the TAIEX broke through 14,800 points, it fell back after selling pressure came about. TSMC's stock price rose during the session to reach NT$494. Chang believes that Taiwan stocks are mainly linked with U.S. stocks. If the U.S. rate hike slows down, Taiwan's stock market will have the opportunity to continue to rebound.

美國聯準會公布月初的會議紀錄,內文暗示不久後將放緩升息步調,傾向12月縮小升息幅度到2碼,以降低過度緊縮的風險,「鴿派」聲量增強。台經院觀察近期國際經濟情勢,10月主要經濟體領先指標與製造業PMI繼續呈現走低態勢,在國內製造業方面,因全球經濟受到通膨及升息影響,終端市場需求疲弱,廠商持續進行庫存調整,投資意願趨向保守觀望,製造業廠商對當月與未來半年景氣看法多呈悲觀與持平。

台經院景氣預測中心主任孫明德指出:「當廠商去化庫存開始在做努力,再加上消費者在接下來如果通膨趨緩,中國解封、消費力道回溫,我想明年在第1季,這些廠商遇到的這些庫存過多、銷售不振的問題,可望慢慢獲得緩解。」

另外,從經濟合作暨發展組織OECD的經濟展望報告也看到,俄烏戰爭引發的能源衝擊繼續刺激通膨,全球經濟將在明年進一步放緩。

台經院院長張建一表示:「當美國的名目利率超過它的CPI的成長率的時候,升息應該就會告一段落。未來如果中國疫後,如果解封的話,中國未來的生產成本如果增加的話,它賣出去的東西價格就會上漲,那也導致美國輸入性通膨增加,這個後續確實值得觀察。」

而台北股市早盤小跌開出後走勢震盪,盤中指數雖然一度突破14800點,但隨著賣壓出籠,又回落至平盤之下震盪,收在14778.51點,下跌幅度0.04%;護國神山台積電股價則是開低走高,由黑翻紅,收在498元,上漲2元、漲幅0.4%。張建一認為,台股主要跟美股連動,若美國升息放緩,股市將有機會持續反彈。