US Stock Drop Amid Fed Hawkish Signals 美聯準會放鷹 美股四大指數全面收黑

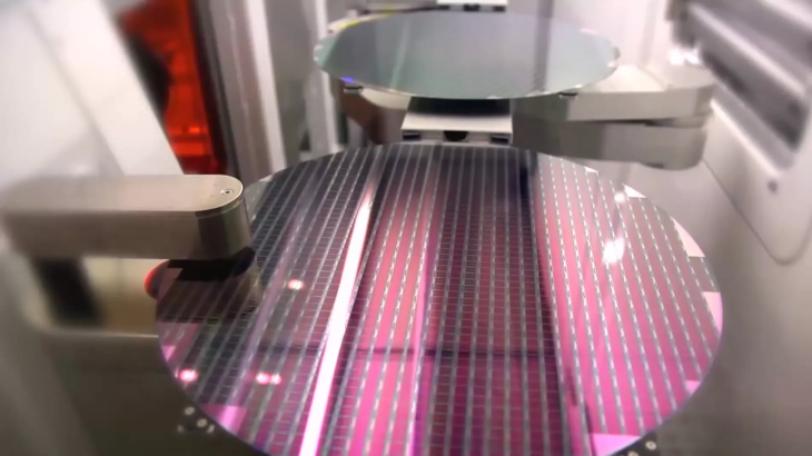

Major U.S. stock indexes closed lower amid hawkish signals from a US Federal Reserve official that dampened hopes of smaller rate hikes after US inflation slowed in October. However, Warren Buffett's Berkshire Hathaway Inc. bought more than US$4.1 billion of stock in TSMC for the first time, causing Taiwan stocks to rise in early trading on the 15th. The TAIEX rose nearly 390 points, breaking through the 14,500-point level. TSMC's stock price once reached NT$487, a surge of NT$42. The New Taiwan Dollar also rose against the US Dollar, close to a two month high.

Although the U.S. stock market was closed on Monday, Warren Buffett's Berkshire Hathaway Inc. bought TSMC's ADRs for the first time. This caused Taiwanese stocks to jump higher in early trading on the 15th, with the TAIEX rising by as much as 390 points during the session and breaking the 14,500 level. TSMC's share price also increased to NT$487, a surge of NT$42.

Wang Jung-hsu, Stock Analyst: “Funds are too concentrated in TSMC, causing other stocks not to have much financial support. So today is actually a performance of individual stocks, with prices being reorganized. After all, the U.S. stock market has actually risen for several days in a row. There was also profit-taking selling pressure yesterday.”

U.S. inflation has cooled down and the U.S. dollar index has fallen for several days, driving hot money back to Asia. The Taiwan dollar rose against the U.S. dollar again on the 15th, appreciating nearly 1 cent during the session closing in on the NT$31 level, a two-month high. Federal Reserve Vice Chairperson Lael Brainard revealed that the central bank may soon slow down the pace of interest rate hikes. However, Fed board member Chris Waller believes the market has overreacted to the softer-than-expected October consumer price inflation data, and the central bank needs to continue tightening its monetary policy. This hawkish comment also drove the Dollar Index to rebound from its lows. Domestic analysts believe that although the current Federal Funds Rate has reached the level of 3.75 percent to 4 percent, the real interest rate compared to inflation is still negative. Therefore, they believe that the continuous increase of U.S. interest rates may be necessary, but the rate of increase may slow.

Chiu Ta-sheng, Researcher, International Affairs Dept., TIER: “The U.S. job market may deteriorate when demand, including private investment, and private consumption are affected. That is when the Fed will consider adjusting its monetary policy. ”

Analysts point out U.S. consumption power will be weakened under high inflation and continuous interest rate hikes, forcing the U.S. economy into a downturn. If the U.S. does not stop raising interest rates, it will affect Taiwan's economics and domestic investments, with the country's GDP growth rate possibly falling below 3 percent.

雖然週一美股全面收黑,但在股神巴菲特旗下的波克夏公司首度買進台積電ADR,激勵台股漲幅2.62%,收在14546點、逼近半年線,台積電漲幅7.87%,上漲35元、收在480元,新台幣兌美元匯率也同步走揚,盤中一度升值近1角,邁向31元整數關卡,續創2個月新高,午盤升4.3分,暫收31.073元。

分析師王榮旭指出:「資金太過集中在台積電以及台積電周邊的一個股票,造成其它的一個個股,失去資金的一個奧援,所以今天其實個股的一個表現,普遍都是呈現整理的狀況,畢竟美國股市其實連漲幾天之後,昨天也出現獲利回吐的賣壓了。」

而美國通膨降溫,美元指數連跌多日,也帶動熱錢回流亞洲,15日新台幣兌美元匯率再度走揚,盤中一度升值近1角,邁向31元整數關卡,續創2個月新高,美國聯準會副主席布蘭納德14日再透露,央行可能會很快放慢升息的步伐,但理事沃勒認為,市場對於意外降溫的通膨數據已過度反應,仍需繼續收緊貨幣政策,此鷹派言論也帶動美元指數自低點反彈。但國內學者認為,現在聯邦基金利率雖然來到3.75%到4%的水準,但相較於通膨的實質利率還是負數,因此認為美國持續升息可能是必要的,只是升息的幅度會稍作考量。

台經院國際事務處研究員邱達生表示:「等到需求,包括民間投資、民間消費都受到衝擊,有可能接下來就是美國的就業市場表現就會惡化,之後他(聯準會)才會考慮調整貨幣政策的方向。」

學者也提醒,美國在高通膨持續升息下,也將使美國消費力道減弱,經濟呈現低迷,要是美國不停止升息,將進一步影響台灣進出口與投資表現經濟成長率往下拉,保3恐不是那麼容易。